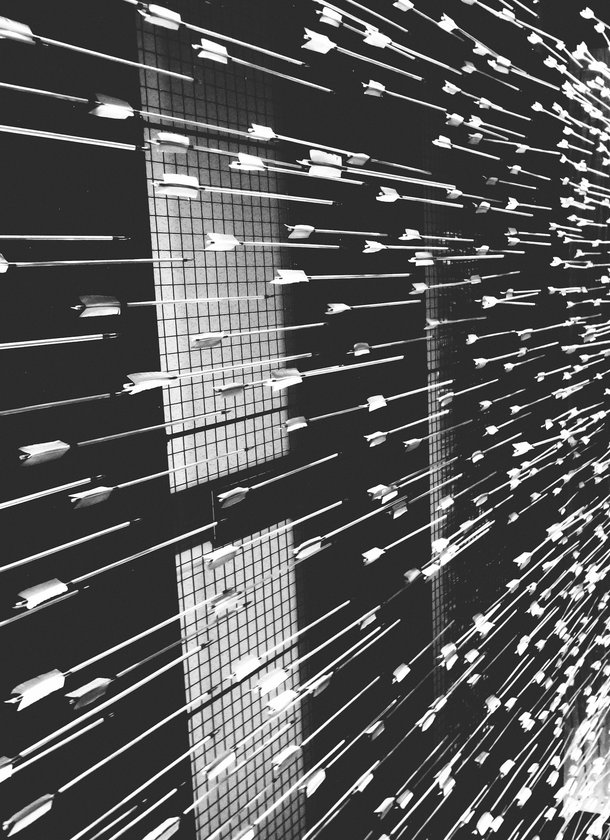

Parallel Tracks for Companies at a Crossroads

We are a boutique investment bank focused on providing excellent advice on mergers & acquisitions, capital raises, and corporate strategy & performance to businesses that are at a crossroads in their lifecycles

Read MoreExplore Our Latest Completed Transactions

Our principals have a 19+ year track record completing transactions totaling over $18.0 billion in aggregate transaction value

Snap Finance Acquires FlexShopper

ArtCreativity Acquires the Wooly Willy® brand

Harbor Acquires Encoretech

Herringbone Digital Completes Add-On Acquisition

Descartes Acquires Finale Inventory

Loftware Acquires BL.INK, Expands Product

An Agile, Senior-Led Advisory Team

Every deal is led by experienced professionals—ensuring clear communication, timely execution, and focused attention from day one.

- John Fang Managing Partner

- Nate Jackson Partner

- Rob Cooper Managing Director

- Kevin He Managing Director

- Josef Zarini Managing Director

Let’s Discuss Your Strategic Options

Whether you're planning an exit, raising capital, or evaluating growth, we’re here to support your next critical decision.

Contact Our Team

Senior Advisors. Smarter Strategy. Better Outcomes.

Our experienced, agile team drives results by leveraging buyer insights, competitive positioning, and decades of successful execution.

Flexibility

We believe it is important to create multiple avenues of value creation, whether through a sale to a strategic party, to a financial party, a capital raise, an acquisition of another business, or the pursuit of one or more roads simultaneously.

Execution

Our time is our most precious resource, and we maximize it by bringing a high degree of planning and expertise to every client and every transaction. We do not make empty promises, and we strive to deliver results through a combination of senior level attention and great execution capabilities.

Speed

We know that market cycles and environments don't last forever, so we make the process of taking your company to market a priority to ensure that working with us is both time and cost efficient for you.

Depth

As trusted advisors to boards, companies, founders, and investors for many years, we bring deep industry relationships, advance knowledge of the key performance indicators that drive your business, and a global network of counterparties to the table when it comes time for a transformative transaction.

Our Services

- 01

Sell-Side M&A

We aim to position your business to maximize your objectives, bring deep and global relationships to help create competition for your business, and negotiate relentlessly on your behalf.

- 02

Buy-Side M&A

We will identify, approach, structure, diligence, and execute transactions to acquire proprietary targets.

- 03

Capital Raising

We will market, structure, and secure growth capital or shareholder liquidity ranging from secured debt to common equity

- 04

Corporate Strategy & Finance

We will provide strategic guidance and financial expertise, supplement or implement a professional and strategic CFO role, and help position your business for sustainable growth and competitive advantage